The real cost of Black Friday for South Africans

Photo: File

By Sebastien Alexanderson

This year, Black Friday will fall on November 26. As has been the trend for the last few years, many retailers have already started offering discounts on goods since the beginning of the month.

Last year, many South Africans took to social media to lament their dissatisfaction with what many termed “Black Friday scams”.

In some instances, prices were inflated prior to the date and then lowered again for Black Friday, with no real savings benefit to consumers. Some media outlets have already started price-comparison checks for this year’s Black Friday and are finding this same scenario to be playing out once again, with several brands and retailers guilty of this artificial inflation. However, there remains no doubt that South Africans will still take part in Black Friday shopping, whether online or in person.

Consumers must carefully consider the cost of their Black Friday purchases, especially if they are not paying cash for an item.

South Africans, like the rest of the world, are tired and drained after another hard year of the pandemic and its consequences. One can understand the human need to buy something, which will either bring some joy to oneself or a loved one. The problem arises when consumers, who have access to credit, use it rashly or without a complete understanding of its full costs, payback terms and conditions.

Last year, we saw consumers opting to load their grocery cupboards with everyday necessities, as well as spending money on big-ticket items like home appliances. Yet many used either their credit cards or even accessed a personal loan to pay for these purchases. By doing this, they not only negated the “saving” on these items but actually ended up paying more.

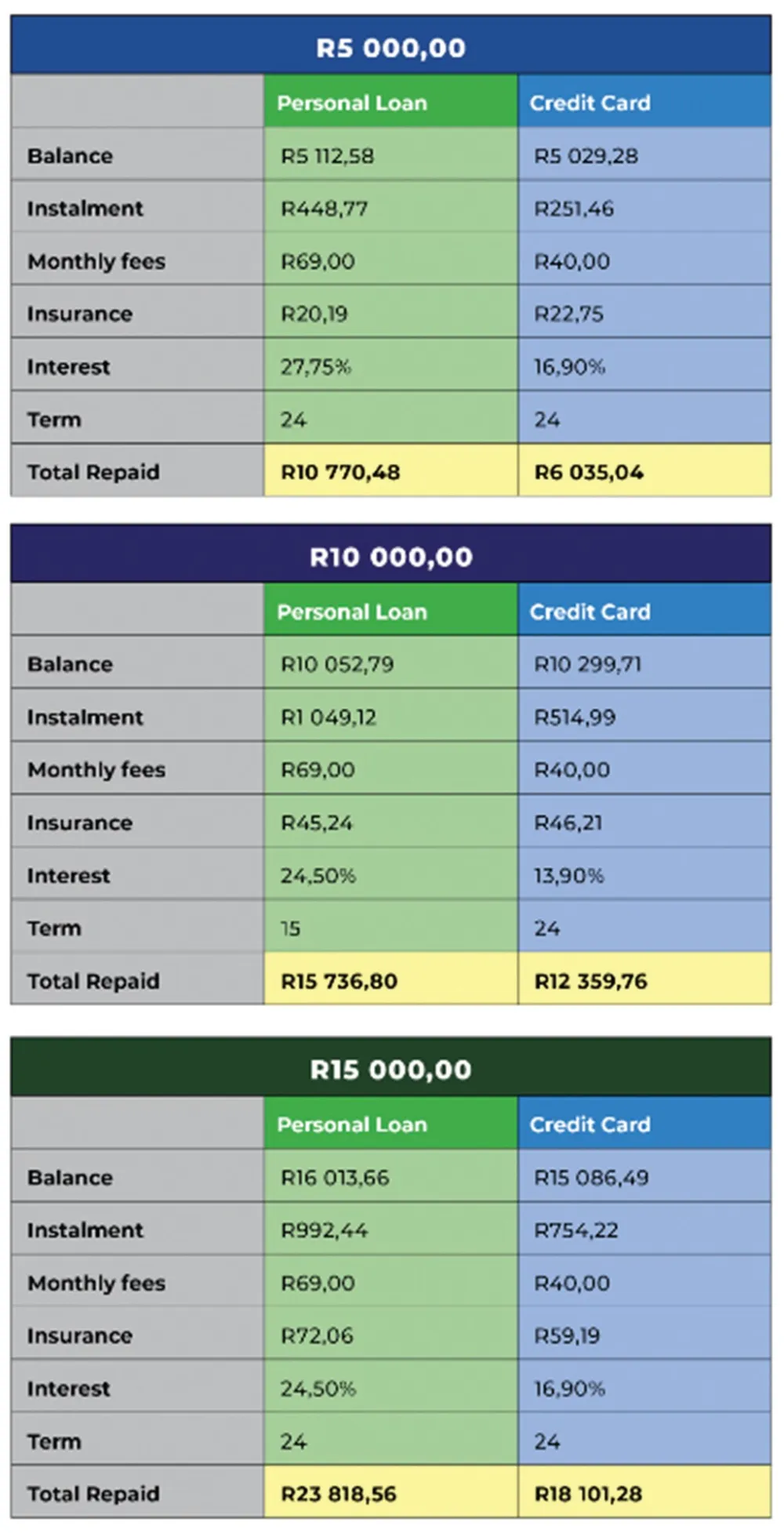

National Debt Advisors did an exercise to show consumers what the real cost of their spending might be, should they be using credit to fund their Black Friday purchases.

Considering varying interest rates and repayment terms, it is clear that there is no real Black Friday – or any day-saving when using credit for purchases.

A television priced at R5000 “cash” may eventually end up costing nearly double that when paid for via a personal loan. “South Africans are notorious for being poor savers. This has undoubtedly been exacerbated by the pandemic. However, it makes sense to rather save R500 monthly over a period of 10 months to be able to afford that same television than accessing credit and possibly paying more than double for your purchase.

Moreover, not being able to keep up the instalments on your credit agreement can see your credit record negatively affected and can lead to harassment by debt collectors and even legal action by creditors.

No one wants to end up over-indebted and in need of debt relief solutions because of Black Friday purchases. Consumers need to seriously consider all the costs and implications of using credit for Black Friday purchases.

In order to help South Africans better prepare for Black Friday, here are top practical tips for Black Friday shopping.

- Decide in advance how much you can spend on Black Friday specials, and stick to that amount when shopping days come around.

- Work backwards from this amount. Make a list of what you wish to buy for holiday gifts and determine how much you can spend. Considering the global impact of the pandemic, family and friends will understand if you scale down on gifts.

- Black Friday is not only for luxury items. Look around for essential items (like food and toiletries) that you can save money on, especially when buying in bulk. Add it to your list and include it in your budget.

- On the day, if you add a purchase/top-up amount to your list – make sure that something comes off your list. Do your best to stick to your plan and your budget.

- Avoid impulse buys of items not on your list.

- Start checking prices for identified products ahead of time so that you are sure that you are really getting a bargain when Black Friday comes around.

- If you start planning early enough, it will obviously be better to save cash for your Black Friday purchases as opposed to maxing out a credit card or taking out a personal loan to accommodate your Black Friday spend.

- Start looking for stores and online shopping platforms that use the rewards system of your debit/ credit/ store cards.

- Be vigilant for fraud and online scams around the Black Friday period.

- When buying on your credit card or using funds from an overdraft or personal loan, take the interest rate and repayment amounts into account. Weigh it up against the “saving” you are getting on an item.

Times are tough, and the struggle is real. Undoubtedly, every Rand saved helps – but be careful not to succumb to the retail advertising hype and madness that can leave you spending money you don’t have.

We need to play our role in stimulating the economy, but not at the expense of our own personal and financial well-being. If you are already struggling to make your debt repayments and don’t have enough money available for everyday living expenses, then the rule is simple – if you didn’t need it before it went on sale, you don’t need it when it goes on sale.

Sebastien Alexanderson is the chief executive of National Debt Advisors.

PERSONAL FINANCE

Related Topics: