Durban seafood business scammed out of R6,492 in online fraud Scammer targets Durban seafood business; owner loses thousands to online fraud

Image: Supplied

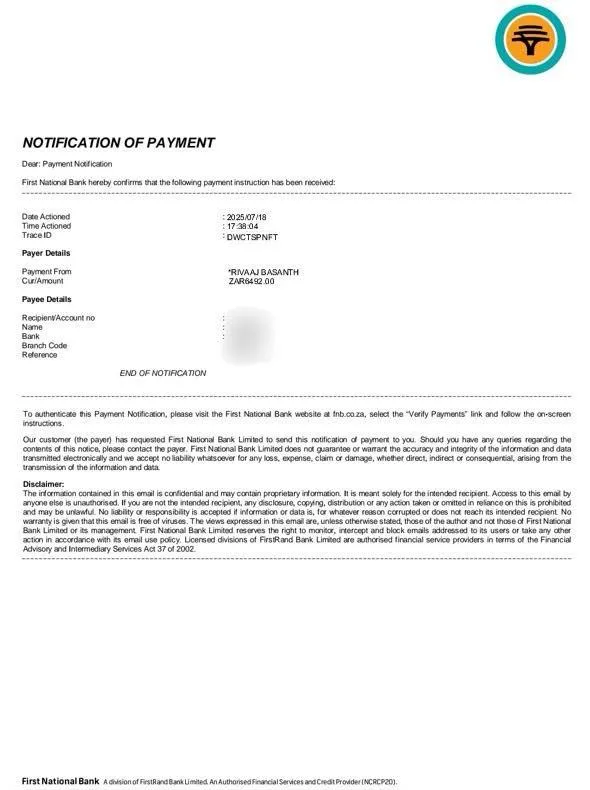

In a shocking incident that underscores the rising tide of online scams, a Durban-based seafood business has suffered a considerable loss of R6,492 at the hands of a cunning fraudster this past weekend. The owner, who remains unnamed, reported the incident to Reaction Unit South Africa (RUSA) after discovering that several Electronic Fund Transfers (EFT) for seafood orders had failed to reflect in their account.

The ordeal began on Friday when the scammer made contact with the business through WhatsApp, placing a sizable order that included seafood boil, prawn platters, and an assortment of frozen seafood. To validate the transaction, the fraudster provided what appeared to be a convincing proof of payment from First National Bank (FNB). Believing the payment to be genuine, the business owner prepared the order, which was subsequently collected by an E-Hailing driver.

The following day, the scammer placed a second order worth R4,300.00. However, the owner’s instinct kicked in, and they requested an instant payment before releasing the goods. The scammer again sent a fraudulent proof of payment, but this time, the owner was wary. Upon contacting their bank for verification, they were informed that the payments had never been made, marking the moment the owner realised they had been scammed.

In a twist of deception, the scammer persistently contacted the owner afterwards, falsely claiming that the payment had been successful. This individual, described as an Indian male, is just one among many con artists employing similar tactics to exploit small business owners.

The modus operandi of these scammers often involves recruiting unsuspecting E-Hailing drivers to collect goods. After providing drivers with an address and directing them to leave the products in unsecured locations, the con artists promptly pay them through cash transfer services while creating an elaborate web of deceit that complicates the recovery of stolen goods.

Scams like this are proliferating, particularly on platforms like Facebook Marketplace, where sellers are pressured into swift transactions without confirming the legitimacy of a payment. “Buyers often target sellers during banking hours or intend to verify payments in a limited timeframe, making it ripe for unscrupulous tactics,” warned a RUSA spokesperson.

In light of this incident, the public is urged to exercise due diligence by verifying all bank deposits prior to releasing any goods, especially during online transactions. As these scams continue to evolve, taking precautionary steps can help guard against future fraud.