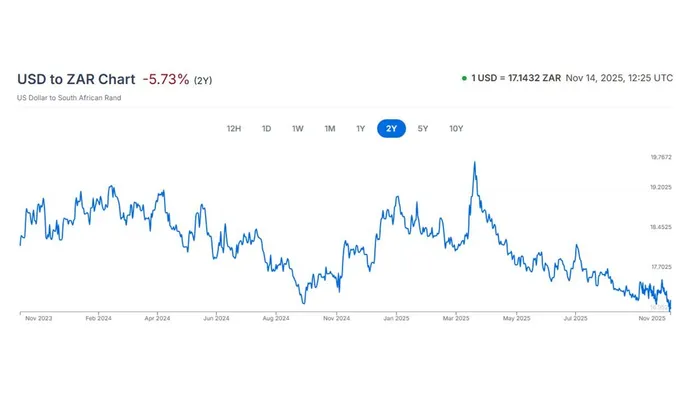

The rand is at its lowest level since February 2023 ahead of an S&P rating review overnight.

Image: PXhere.com

With an S&P rating review expected overnight, the rand will either have a horrible post-budget hangover or carry on partying.

Having breached R17 to the dollar for the first time since February 2023, the local currency has lost some of its shine after euphoria over what analysts are seeing as a solid and good-news budget faded.

Economists are eagerly awaiting a decision from S&P as to whether South Africa will get a bump up in credit ratings, which could again bolster the local currency.

That news will land overnight.

S&P previously stated it may upgrade ratings if effective reforms boost economic growth and reduce government debt and liabilities.

For the period between 2025 and 2028 S&P, expects economic growth to average 1.5%, while Investec forecasts 1.7% for the period, after 0.5% in 2024.

This afternoon, the currency is pretty much back to where it was just before Wednesday’s Medium-Term Budget Policy Statement (MTBPS). It’s currently trading at R17.15.

Marco de Matos, research analyst at Anchor Capital says “we have been expecting rand strength for a while”.

A number of factors remain supportive of the rand, he says.

“Much of the movement is attributed to the mini budget, which was market positive for both bonds and the rand.”

The dollar has lost ground against the rand in the past year.

Image: XE.com

De Matos adds that “we think the rand benefitted most from the reduction of the inflation target to 3%. That said, the end of the US shutdown has also been a supportive factor.”

In fact, its best level in the past five days was seen yesterday when it dipped to R16.95.

Andre Cilliers, currency strategist at TreasuryONE, noted this morning that the rand had dropped below R17, and was being driven by local improvements regarding the fiscus and inflation outlook and optimism over an S&P ratings upgrade.

Still, it could be worse. And has been.

In April, the currency looked set to go over R20 at the rate it was weakening.

Just last week Friday, Investec chief economist Annabel Bishop noted that it was averaging R17.30 for the quarter.

On Monday, she wrote little that it was seeing volatility this quarter as market sentiment is slightly more neutral from risk-on in October.

Part of the gains this year are attributable to US dollar weakness of 8.9% overall, which saw the rand strengthen by 8.5% against the US dollar in the same period, wrote Bishop.

The JSE has also benefited from general happiness, having gone over 115,000 for the first time in its 138-year history.

Peter Little, fund manager at Anchor Capital, said much of this year’s gain – a 40% year-to-date return – is due to metal prices and Naspers’ share price growth.

As Bianca Botes, director at Citadel Global, says “credible fiscal consolidation, the lower inflation target, grey list removal, and favourable commodity prices has materially improved South Africa's investment case”.

Botes notes that “markets are responding to tangible progress rather than promises, with debt stabilisation providing a foundation for sustainable growth.

“While vigilance regarding execution risks remains essential, sentiment toward South Africa has shifted decisively to positive, creating opportunities for both local and international investors who have long waited for signs of structural improvement,” she adds.

IOL Business