In May 2025, people and businesses in South Africa borrowed more money than before — credit demand rose by 5.0%

Image: Pexels

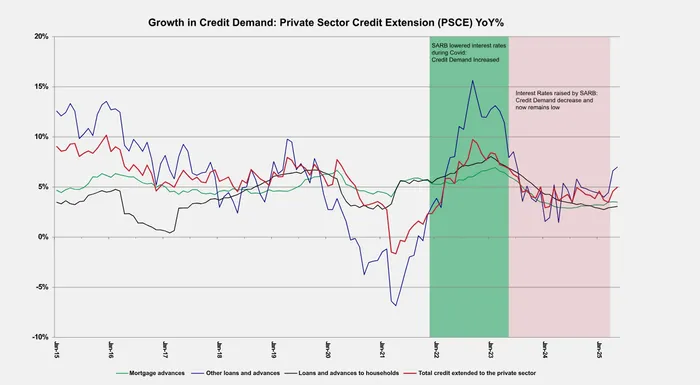

In May 2025, South Africa witnessed a notable increase in credit demand, growing by 5.0%, a figure that not only surpassed April's 4.6% but also exceeded market expectations, which were set at 3.0%.

This uptick has been attributed to the three consecutive interest rate cuts initiated in September 2024. The substantial total reduction of 175 basis points, alongside an additional 25-basis point cut on 29 May, has sparked a renewed momentum in overall credit growth, with most subcategories recording increases during the month.

However, while the demand for credit is on the rise, mortgage advances and credit for fixed asset purchases remain notably subdued.

This stagnation can be traced back to late 2023 when rising interest rates significantly hampered property demand.

Since interest rate cuts began in September 2024, overall credit growth has gathered momentum, with most subcategories recording increases during May.

Image: Supplied

Despite the recent easing of rates, high consumer debt levels, stagnant wages, and increasing living costs continue to limit a robust recovery in the property sector.

Analysts believe that the onset of improved household disposable incomes later in 2025, propelled by a positive market sentiment, could shift this narrative.

In detail, the instalment credit sales have seen a modest increase of nearly 1% month-on-month in May, following a 0.3% rise in April.

The annual growth rate has also reached an encouraging 6.2%. Over the last two years, many consumers have increasingly turned to short-term credit options to cope with escalating living expenses, as evidenced by a significant 7.0% increase in other loans and advances. This figure shows an improvement from the 6.6% growth recorded in April.

Amid these fluctuations, mortgage advances grew by just 3.5% in May, reflecting a continuation of April's subdued growth figures. Analysts remain cautiously optimistic, noting that the full advantages of the latest rate cuts are likely to emerge later this year.

With inflation trends remaining favourable, continued reductions in interest rates are expected to bolster disposable incomes, ultimately driving enhanced demand for both goods and fixed assets as 2025 advances.

As the landscape of credit evolves in South Africa, stakeholders eagerly anticipate how these economic shifts will unfold in the second quarter of 2025 and beyond, impacting not only buying behaviours but also broader market health.

IOL

Related Topics: