Consumer inflation dips to 3.8% in September - here’s what it could mean for the interest rate

The interest rate cutting cycle is expected to continue until at least 2026. File picture: Markus Spiske via Unsplash.

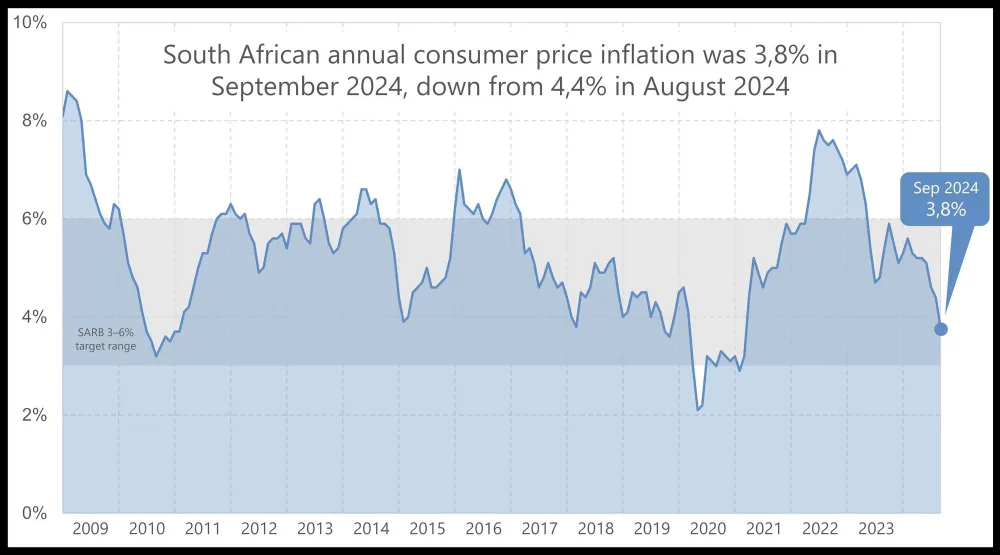

Annual consumer price inflation (CPI) declined to 3.8% in September, its lowest level since March 2021, Statistics South Africa (Stats SA) said on Wednesday.

This was mainly led by lower fuel prices, which decreased for the fourth month in a row, leading the transport sector into deflationary territory for the first time in 13 months, with the annual rate falling from 2.8% in August to -1.1% in September.

Food inflation remained unchanged at 4.7%, while housing and utilities rose by 1.1%, largely thanks to electricity prices having risen by 11.5% over the past year. Fuel prices, meanwhile, have fallen by 9% in that period, although a moderate increase is expected in November.

Notwithstanding, softer fuel prices, moderating food costs and a stronger rand, which has gained 5% since the formation of the Government of National Unity in June, have all helped to ease price pressures in the past few months, PPS Investments said.

“Looking ahead, the current rate of inflation should offer the SARB some peace of mind. While most economists expect the deceleration in inflation will encourage the SARB’s monetary policy committee to cut rates by a quarter point for a successive meeting in November, some see scope for a larger reduction,” said Mark Phillips, head of analytics at PPS Investments.

However, the South African Reserve Bank (SARB) may exercise caution about the potential impact of conflicts in the Middle East.

“While disinflation is on track and policymakers forecast inflation will hold in the bottom half of their 3.0%-6.0% target band over the coming quarters, uncertainty remains,” Phillips added.

“It is cautioned that risks to the inflation outlook remain, including the uncertainty over how far and how fast global financial conditions will ease as other central banks cut borrowing costs.”

Most analysts expect to see a quarter percent interest rate cut in November, and a worsening fuel price outlook could well prevent a bigger cut from materialising.

The SARB’s Monetary Policy Committee announced a 25 basis point cut in September, reducing the repo rate to 8%. This was the country’s first rate cut in over four years, and the cutting cycle is predicted to continue for at least two years.

Annabel Bishop, chief economist at Investec, expects a gradual rate cutting cycle that, through small increments of 0.25%, should add up to a total of 150 basis points by March 2026.

IOL

Related Topics: