Future of sovereign bonds remains uncertain

The JSE All Bond Index has returned 3.8% over a one-year period in rand terms, but lost -2.8% in dollar terms. Picture: File

The future of sovereign bonds, emanating both locally and globally, remains uncertain. But locally the asset class looks alluring in an investment market that has flatlined elsewhere.

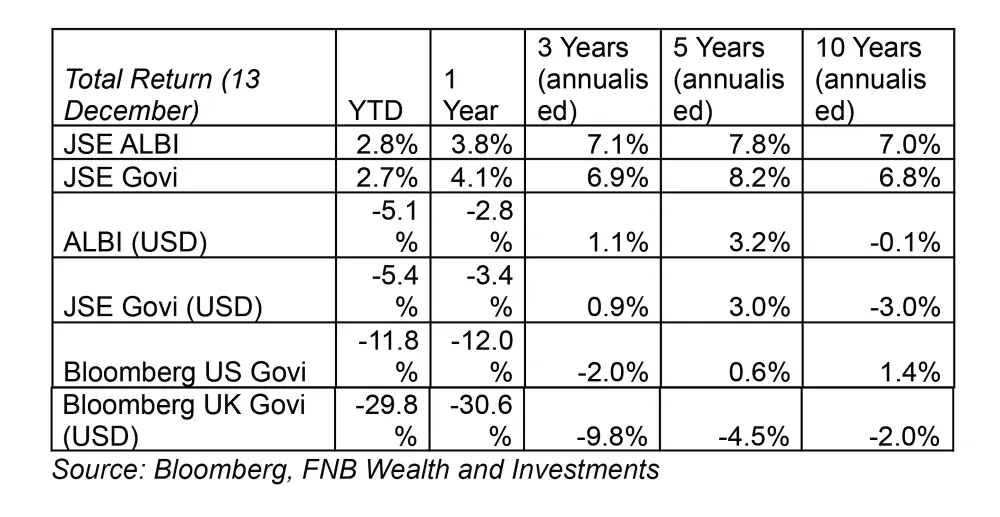

The JSE All Bond Index (ALBI) has returned 3.8% over a one-year period in rand terms, but lost -2.8% in dollar terms. While underperforming inflation over the past year, South African bonds have performed much better than the US Treasuries and UK Gilts. According to the Bloomberg US Government Bond Index, it has retracted by 12% over the past year and the Bloomberg UK Government Bond Index is almost a third below its value a year ago.

However, near-term returns must be viewed in context, says Chantal Marx, head of investment research and content at FNB wealth and investments.

“A rising interest rate environment detracts from the relative attractiveness of bonds and increases borrowing costs – making it more challenging to service the debt. In the UK, specifically, political turmoil has been a mainstay over the past five years, and this has detracted from the investment allure of that market.

“In South Africa, a better fiscal position – particularly in the context of high commodity prices providing a tax windfall for the fiscus – has shielded our bond market from other country-specific issues like load shedding, ineffective state-owned enterprises and social and political unrest. Still, we have also experienced the impact of higher interest rates globally and the resultant weaker rand when considering dollar returns,” Marx says.

Over a 10-year time frame, local government bonds have returned 6.8% per year in rand – providing inflation-beating returns in the South African context. While it has underperformed US government Treasuries over this period in dollar terms, it has outperformed UK Gilts.

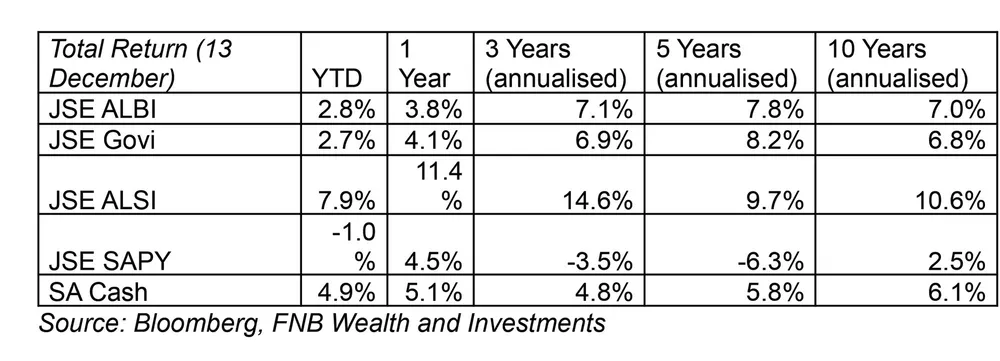

Against other asset classes locally bonds have lagged other asset classes, except for listed property, over the past year. Over the very long term, it has outperformed cash and listed property, but underperformed local equities.

“This is not surprising given the underlying dynamics of each asset class,” adds Marx.

Ian Scott, head of fixed income at Momentum, says the biggest fear for investors regarding government debt is a fiscal crisis or default, but a country that largely borrows in its own currency still has some wiggle room left, unlike some of South Africa’s emerging economic counterparts. Argentinian investors, and more recently Ghanaian debt-holders are a case in point.

The problem in South Africa is not that we lack money, as better-than-expected gross domestic product figures and tax collections’ recent figures show, but rather that the country doesn’t prioritise essential service delivery and spend efficiently.

Scott says the fact that the bulk of the local deficit will be borrowed in the local bond market, always makes for good news, and also feels that most of the bad news regarding failed state endeavours have already been priced into local bond prices.

Sovereign bonds, excludes municipal, retail and state-owned enterprise Treasuries, and earn an overall conviction score of medium to high, according to various analyst reports. This is largely driven by the relatively high nominal and real yields, which offer an attractive entry point for those investors willing to focus on the long term rather than short-term price movements, Scott says.

“In an environment where inflation is around 7.8% and SA government bonds are yielding close to 13%, we believe the real yield of around 5% is an attractive investment opportunity,” says Scott. The yields on offer provide sufficient compensation for the risks associated with the asset class.

Finance Minister Enoch Godongwana’s Medium-Term Budget Policy Statement did set the scene for a two-to-three-year rally in South African bonds, which could enjoy additional impetus from a potential end to the current cycle of global monetary tightening as soon as mid-2023, and economists predict that the country has reached the peak of its interest rate hike cycle.

A likely recovery in the South African bond market in 2023 is also the view of some prominent asset managers, coupled with a further pivot from the US Federal Reserve, which could potentially set the scene for foreign investors to return to local government debt. That would snap almost five successive years of net sales of local bonds by offshore investors, which according to Bloomberg data at the end of October was over R390 billion.

The Federal Reserve continues its battle against inflation by raising its benchmark interest rate by half a percentage point to the highest level in 15 years, last week.

Omri Thomas, a director and portfolio manager at Abax Investments, says that historically local bonds have outperformed in absolute terms in light of returns, real terms compared to inflation and in relative terms when other developing and developed debt markets are taken into consideration.

“The currency hedge also makes it an attractive proposition,” he says, “where most other emerging economies have their sovereign debt priced in US dollars.”

BUSINESS REPORT

Related Topics: