Watch your ‘cents and rands’ to weather the storm as further interest rate hikes not ruled out

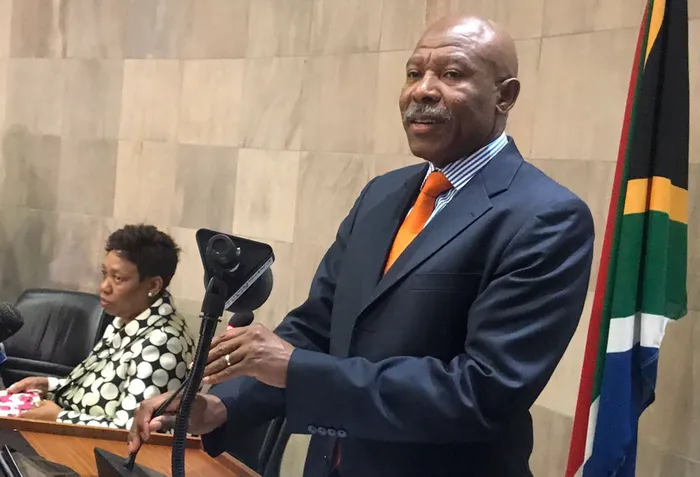

SA Reserve Bank governor Lesetja Kganyago. File photo: ANA

The South African Reserve Bank (SARB) has given a strong indication that it might increase the borrowing costs as risks to the inflation outlook are assessed to the upside, even though it has paused its interest rates hiking cycle for now.

In a split decision, the Sarb on Thursday kept its benchmark lending rate unchanged at a 14-year high of 8.25% per annum for the first time after 10 consecutive hikes since November 2021.

Frank Blackmore, Lead Economist at KPMG, said, “Although the risks remain to the upside, those risks include a decrease in export prices of our commodities. This may lead to a current account deficit that's forecast for the year, the El Nino situation and its impact on agriculture, the lower tax revenue collection, and above inflationary increases in wages that keep interest rates elevated, as well as the rent remaining volatile - all these are risks to the upside for inflation. However, the most recent read from June at 5.4% showed that the monetary policy was restrictive enough to reduce inflation to 5.4%, and this is expected to continue over the rest of the year.”

“The governor did state that this may not be the end of the hiking cycle, and they will react to the most recent data at each of the meetings that are yet to come,” Blackmore further said.

Brina Biggs, Senior Manager at 1Life Insurance told Business Report that South Africans can breathe a sigh of relief as rates remained unchanged.

“This, however, is probably not the end of the interest rate hiking cycle, which is still only expected early next year. Yet, we have to remember that while inflation is at a 20-month low, the reality is that any increase here will mean more pressure on consumers down the line. We need to consider load shedding and inflationary factors such as CPI and retail sales amongst many that can cause changes to the outlook. So, we urge consumers to stay the course as we adapt the saying to “watch the cents and the rands will take care of themselves,” as we continue to weather the storm of our current high cost of living,“ Biggs said.

Hayley Parry, Money Coach at 1Life’s Truth About Money, said that for the first time since November 2021, SARB’s MPC had given us reason to exhale if not celebrate.

“That's because after 10 consecutive interest rate hikes, they have decided to pause this hiking cycle and leave the repo rate unchanged at 8.25%. What does that mean for you and I? Well, if you were looking for a higher interest rate on your savings, I'm afraid you're not going to get it but for those of us repaying any kind of debt, whether that's a home loan, car loan, store cards, credit cards, overdraft - it means that we're not going to be paying more to service the same amount of debt. That's great news for your wallet, your bank account and for the time being no need to find out how we need to tighten our belts just yet,” Parry said.

She further said, “Here's the challenge to you - if the interest rate had been hiked by 25 basis points which is what two of the five committee members wanted to do. You would have needed to find that money in your budget to repay the debt that you owe. So, my challenge to you is to find that money anyway and to put it towards those debts so that you can pay it down faster. This is what happens when you are financially savvy, when you get yourself a financial education. This is how taking the news from the headlines and using it to improve your own personal financial situation can really help you move yourself forwards financially.”

Andra Nel, Purpose Manager at KFC’s Add Hope, said that the announcement of a stabilised and unchanged repo rate will have many consumers breathing a sigh of relief.

“After months of recurring increases and having to make fundamental changes to the way they manage their household income, many families go without a meal because they simply can't make ends meet and it's great to know that for now there won’t be further dire consequences. However, the reality is that there is still an incredibly uncertain climate at the moment and that people still need to keep an eye on what happens in the CPI context, and it’s impact as it will have an impact on middle income families, but also on the poorest of the poor who are struggling to make ends meet,” Nel said.

“We need to make sure that we do not take any focus away from creating sustainable and future proof solutions for food security in South Africa. Add Hope maintains that improvements in the country's economic standing has a direct impact on food security, and we are positive at the outlook presented by the Revenue Bank, but we also know that we need to keep on collectively driving change so that the most vulnerable, our children - the future of this country - have got everything they need to make sure that they can realise their potential,” Nel further added.

BUSINESS REPORT