SA Reserve Bank seems unlikely to cut rates before the year end

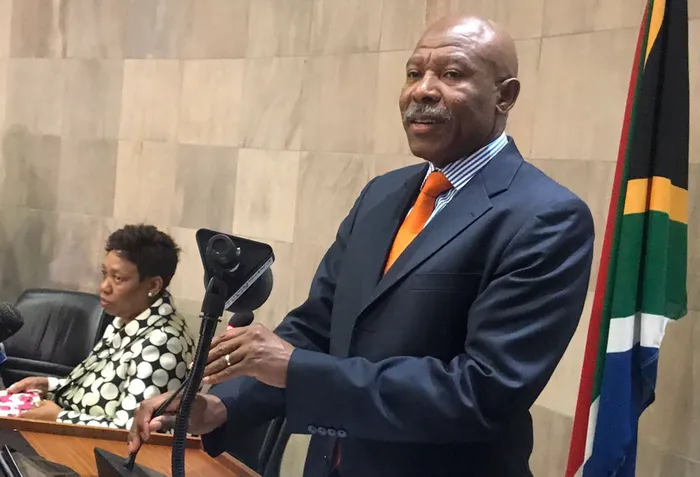

SA Reserve Bank governor Lesetja Kganyago. File photo: ANA.

The South African Reserve Bank (SARB) has given the strongest indication yet that it will not begin cutting interest rates before the year ends as it need to tame inflation to the midpoint of the target range for a sustainable period.

In its October Monetary Policy Review published yesterday (Tuesday), the SARB said that upside risks to inflation had strengthened over the past months, heightening uncertainty about a precise path for inflation.

The SARB said that in spite of headline inflation decelerating towards the 4.5% midpoint of the target range, upside pressures to core inflation were reflected in still elevated survey-based inflation expectations and a weak rand, with further risks emanating from load shedding.

Headline inflation rose to 4.8% in August and September, and is projected to average 5.9% in 2023, down from 6.9% in 2022, and to only settle at the midpoint of the target range in the second quarter of 2025.

The bank said the recent pickup in global oil prices and expected drier weather conditions add to inflation risks.

However, it is the core inflation that is giving the SARB sleepless nights as it remains stubbornly high.

The bank forecasts core inflation, which excludes food and fuel costs, to rise to 4.9% in the current year before gradually sliding back to the midpoint of the target range by 2025.

“Despite global headline inflation slowing significantly over the period under review, risks linger, in particular from oil and weather-related food price developments,” said the SARB.

“The enduring stickiness in core inflation, alongside the gradual fragmenting of global trade and finance networks, suggests upward revisions to global neutral interest rates.”

The SARB’s Monetary Policy Committee (MPC) raised the repurchase (repo) rate by 50 basis points at the May, taking the nominal repo rate to 8.25%, with decisions in July and September to hold rates steady.

However, it noted that persistent inflation and elevated inflation risks will keep global interest rates higher for longer, presenting challenges to emerging markets that require global savings inflows and threatening currency stability, with knock-on effects to domestic inflation.

“The bank’s Quarterly Projection Model (QPM) forecasts indicate that the current level of interest rates will be sufficient to steer inflation back to the midpoint of the 3–6% target range over the medium term,” it said.

“The MPC will continue to assess incoming data and fine tune the stance as needed to manage risks and ensure that inflation stabilises at the target.”

The SARB has projected the economy to expand by just 0.7% this year, rising to 1.1% by 2025.

It said growth has weakened significantly this year and over the medium term as the energy supply constraint has become more binding.

While not in the SARB’s current baseline, expectations are for the ongoing reforms in the energy and logistics sectors, alongside the private sector’s robust response to the energy crisis, to eventually lift both GDP and potential growth in the long run.

“The implementation of structural reforms to ensure an adequate supply of energy, enhance efficiencies in logistics, improve dynamism in product and labour markets and reduce the impact of administered prices on inflation should raise both GDP and potential growth, while enhancing monetary policy’s role in keeping economic activity buoyant closer to the new and higher potential level,” the bank said.

BUSINESS REPORT